Packaging solutions: Poised to take off

Major trends are reshaping packaging solutions and that could open new opportunities for players that are prepared to move fast.

In the early 19th century, the French government offered a prize of 12,000 francs to the inventor who could create the best container for preserving food for Napoleon’s army and navy. That contest gave rise to the tin can. The number of packaging innovations that have surfaced since that time are too numerous to count. Just a few notable examples are gable-topped milk cartons, bubble wrap, and single-serve pouches.

Packaging originally served as just a container, but its role has evolved to include more sophisticated functions, such as advertising. Some packaging is so iconic and easily recognizable that consumers automatically look for it when shopping. Recently companies have begun investigating smart packaging equipped with sensors. The packaging industry has evolved as well. Packaging solutions (PS) is now a $900 billion market and an important segment within the broader industrial sector. Within PS, players are classified as either packaging converters, which produce or provide materials for packaging, or equipment companies.

After years of failing to create value, the PS sector has generated economic profit every year since 2013. It has also closed the performance gap with the industrial sector as a whole, which has long had a better track record. Three factors are behind this improvement. First, PS companies improved operational performance, with margins of earnings before interest, taxes, depreciation, and amortization expanding to 10.3 % for the period from 2013 to 2017, up from 8.3 % for the period from 2002 to 2007. Second, they used capital more efficiently. Capital turns improved to 1.9 times for the period from 2013 to 2017, compared with 1.7 times for the period from 2002 through 2007. Finally, PS companies had steady revenue growth. They achieved a 2.2 % compound annual growth rate from 2013 to 2017, compared with 1.4 % for the industrial sector as a whole.

Play Video

When we reviewed performance within the PS sector, we found that a few companies strongly outperformed others in each packaging subsegment. After investigating the reasons for their outstanding performance, we found that performance is strongly predicted by a company’s Quality of Revenue (QoR) a measure that focuses on three strategic elements that often determine the extent of a company’s success: products, strategy and operations, and business models.

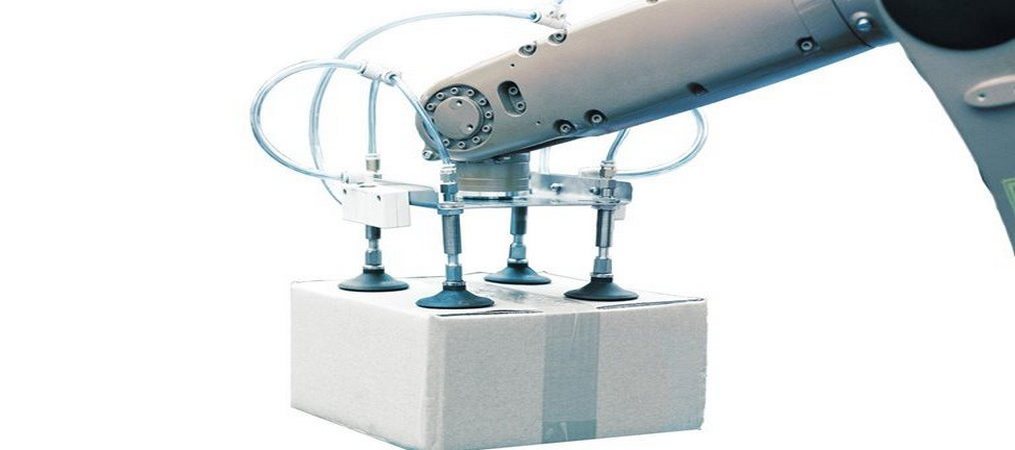

We believe that the PS industry is poised for additional growth as several trends including continued growth in e-commerce and emerging markets, shifting consumer preferences, increased interest in sustainable materials, and the integration of advanced technologies into packaging create tailwinds.

These trends will create new opportunities for PS companies to improve all three dimensions of QoR significantly. New technologies will help them accelerate product innovation, enable new business models that increase profits, and drive the next wave of operational efficiency through advanced analytics, next-generation manufacturing, product improvement, and footprint optimization.

While the exact starting point will vary by company, we believe there are three imperatives for PS players as they try to navigate an increasingly dynamic business environment, improve QoR, and capture value over the next few years. First, companies should consider taking aggressive moves to close the gaps between their current performance and full potential. Second, companies should develop pragmatic game plans for improving QoR and moving to action quickly. Finally, they must establish strong governance and performance-management backbones to ensure success.

McKinsey